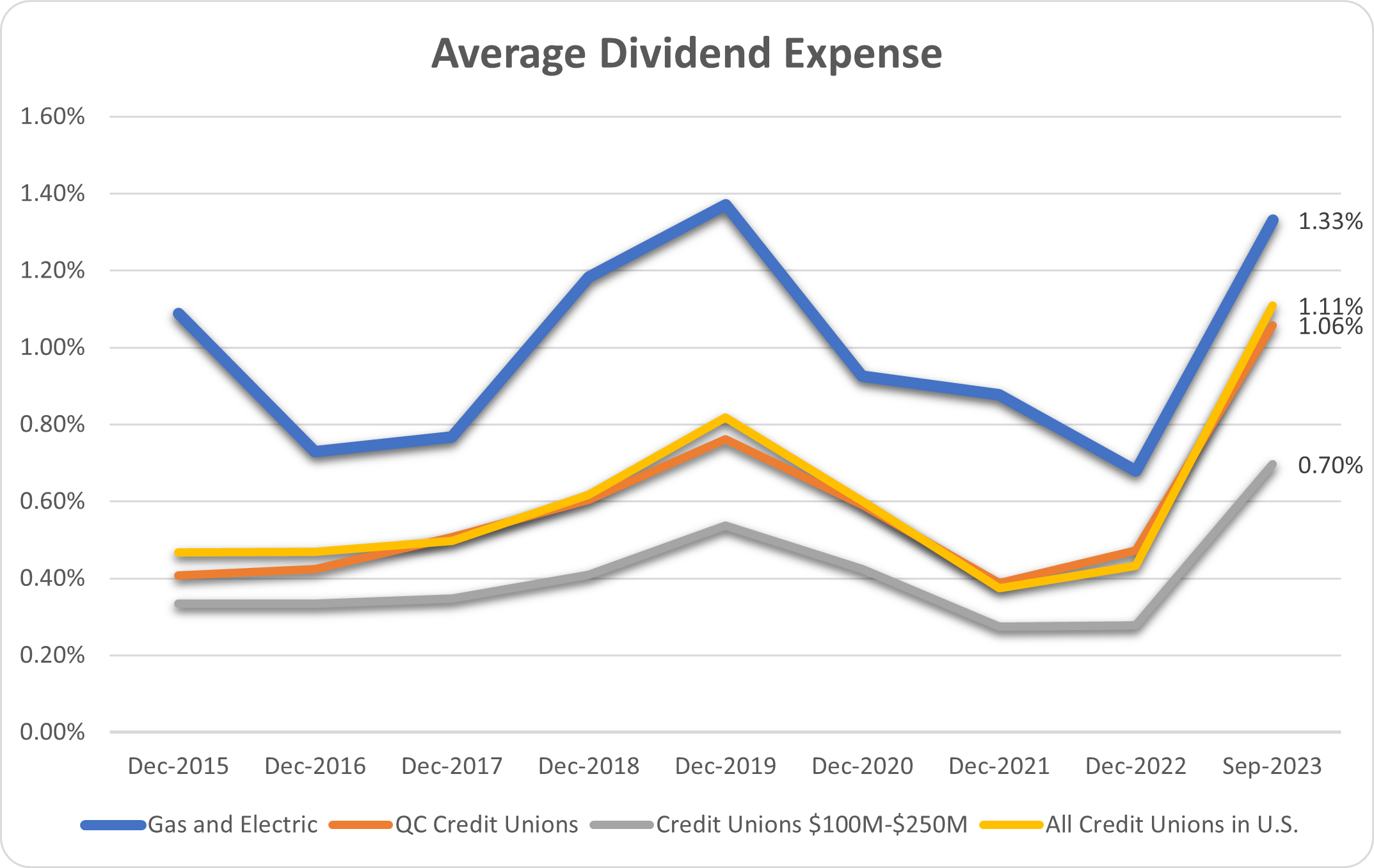

We take great pride in a lot of things at GECU – our exceptional member service, our low fees, our great rates on loans, and more. But one area where we have always stood out has been our savings rates. Whether it’s our Green² Checking account paying 3.00%, or our Money Market Account, or CDs, we have traditionally paid among the best rates in the nation. Even when interest rates were at record lows for much of the past decade, our average dividend rate has been higher than every other peer group – whether it’s other credit unions in the Quad Cities, credit unions in our same asset size, or all credit unions in the entire country. We have always made sure to give back to our members on both sides of the balance sheet – savings AND loans. And in those years where we have been able, we’ve even paid out a bonus dividend to members, totaling over $1.2 million.

Now that interest rates are rising, we have seen Certificate of Deposit rates increase to the highest level in over a decade. Competition is fierce, as credit unions and banks are trying to attract and maintain our deposits. One thing you may have noticed, however, is that many institutions offer strange terms for their highest CD rates – 11 months, 13 months, 19 months, etc. And you may have wondered why this is. Well, the other thing that sets GECU apart is transparency. So I want to take this opportunity to let you in on our industry’s little secret.

First, you’ll notice that we don’t play these games at GECU. Yes, our 12 month CD is our highest rate, but we offer this rate to everyone. If you have an existing CD that matures, you will automatically receive this new rate. Have a 24 month CD maturing? You can cash it in and change to the 12 month CD if you choose. When we raise rates, we want all members to benefit. Now here’s the reason for those odd terms. First, many institutions only offer that new high rate for new money, or for deposits over a certain amount. If you read the fine print, you will find this out. But offering that high rate on a special term has the same effect. If you have a regular CD maturing, they are hoping you don’t notice that new rate, and just let your CD roll over into a much lower rate. Your 12 month CD just matured? Oh, sorry that the new rate is for the new 11 month CD and we didn’t notify you about this. I guess you missed out.

While many members do pay attention, many just let their CDs roll over at maturity. By not offering their best rate on a standard term, institutions hope to lower their dividend or interest expense and save some money. We could do the same, but that goes against our core values. All members should benefit, not just new members or new money.

If that philosophy sounds good to you, then perhaps give us a second look. Maybe our CD rates aren’t quite the highest in the market. But we don’t play games either, and when we have success, we share that success with you. We’re in this for the long haul, and that means being transparent and honest with our members.